Autumn Budget: What it means for you 23 | 11 | 2017

CHANCELLOR OF THE EXCHEQUER Philip Hammond delivered his second Budget speech yesterday. Below we highlight the Chancellor’s key Budget measures that will impact on the company car and van sector and wider motor industry.

Company car benefit-in-kind tax

Two measures were announced in the Budget that impact on company car benefit-in-kind tax:

• A rise in the existing company car tax diesel supplement from 3% to 4%, with effect from April 6, 2018 (details below).

• Carbon dioxide (CO2) figures compatible with the current New European Driving Cycle (NEDC) test procedure will be used by HM Revenue and Customs for the purposes of collecting company car tax until April 2020. The government will however also take forward legislation in a future Finance Bill that will change the system for measuring carbon dioxide emissions to the Worldwide Harmonised Light Vehicle Test Procedure (WLTP) from April 2020 (details below)

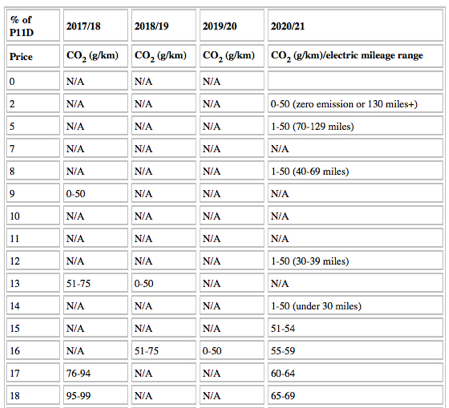

Due to the decision to introduce WLTP-based emission data from April 2020, the government did not announce company car benefit-in-kind tax rates for years beyond 2020/21, which were previously announced (see chart below).

Industry experts have suggested that CO2 figures on a car-by-car basis could increase by about 20% with introduction of the WLTP emissions data. However, whether CO2 emission thresholds will be recalibrated to take account of any increase remains to be seen.

If tax thresholds remain unchanged then the likelihood is that company car benefit-in-kind tax bills will rise significantly. Such an increase would be in addition to increases already announced from 2018/19 as highlighted in the chart below.

Diesel supplement increase

Approximately 800,000 employees who drive a diesel company car will pay more benefit-in-kind tax, according to the government as a result of its decision to increase the existing company car benefit-in-kind tax supplement from 3% to 4% from April 6, 2018.

The government says the measure - along with changes to Vehicle Excise Duty (see details below) - will pay for a near Clean Air Fund as part of the National Air Quality Plan published in July 2017. The £220 million raised will allow local authorities in England with the most challenging pollution problems to help individuals and businesses adapt as measures to improve air quality are implemented.

The rise from 3% to 4% applies to all diesel cars that are not certified to the Real Driving Emissions 2 (RDE2) standard.

The supplement will apply to diesel cars (not hybrid diesels) registered on or after January 1, 1998, which do not have a registered nitrogen oxide (NOx) emissions value. It will also apply to models registered on or after January 1, 1998, which have a registered NOx emissions value, which exceeds the RDE2 standard.

The RDE2 standard is a measure of how close a vehicle gets during real-world emissions testing to the emissions measured during the NEDC and WLTP test. It sets a maximum permitted level of car NOx emissions.

The European Union timetable for the introduction of RDE2 means that it is almost certain that no diesel cars currently on the UK roads will be exempt from the increased charge. Indeed, the government says: “It is likely that few, if any cars, cars will meet RDE2 standards in 2018 to 2019.”

As a result, the government calculates that 800,000 drivers will pay more tax as a result of the supplement increase. However, the government says that 350,000 company car drivers per year replace their company cars, so within a few years, most affected drivers would have had the opportunity to choose new cars not subject to the supplement.

The government calculates that drivers of a BMW 3 Series (CO2 emissions 111-130g/km) will see tax bills rise in 2018/19 by £60 (basic rate taxpayer) and £120 (higher rate taxpayer), a BMW 6 Series (CO2 emissions 131-150g/km) by £125/250 and a Ford Focus (CO2 emissions 91-100g/km) by £43/£86.

In 2018/19 the government forecasts that the supplement will raise £70 million, reducing to £35 million in 2019/20. In 2020/21 the net loss to HM Treasury is calculated to be £30 million as employees switch away from diesel cars. However, in 2021/22 and 2022/23, the government has predicted that the measure will raise £130 million and £90 million respectively even though it has not announced company car benefit-in-kind tax rates for those years.

The measure removes the diesel supplement altogether for diesel cars that are certified to the RDE2 standard.

For any employees driving cars that meet the standard and are therefore exempt from the new 4% supplement, HM Revenue and Customs says it will issue guidance on how they should be treated so that the diesel supplement is disapplied. The government currently estimates that will affect the “low hundreds” of employees.

For 2019 to 2020 onwards, employers will have to note reported NOx emissions for new diesel cars and check whether or not they meet the RDE2 standard. The government says that information will be available on the same documentation - the certificate of conformity - which lists a car’s CO2 emissions figure.

Introduction of WLTP for company car benefit-in-kind tax and VED

Company car benefit-in-kind tax and Vehicle Excise Duty is based on CO2 emissions figures from the current NEDC test procedure. From September 1, 2017 the new WLTP test procedure was introduced.

The government has clarified that NEDC figures will continue to be used until April 2020, when the new WLTP figures will be introduced.

The government has said that following discussions with the car industry it considers that the timeline for introducing the new system will give manufacturers time to reflect the new values in all of their vehicles, and to explain to customers what the change will mean.

Company car tax 2017/18 to 2020/21

• From April 6, 2018 for each tax year add 4% for diesel cars up to a maximum of 37%. Cars that meet the Real Driving Emissions Step 2 (RDE2) standard are exempt.

Taxation of benefits-in-kind and employee expenses

In March 2017, the government published a call for evidence as to how the taxation of employee business expenses could change.

Employers can choose to remunerate their employees in a range of different ways, but the tax system treats those different forms of remuneration inconsistently.

As a result, the government said it was considering how the tax system could be made fairer and more coherent, including by looking at the taxation of benefits-in-kind and employee expenses.

The government has now said that it will make “several changes” to the taxation of employee expenses.

Those changes include HM Revenue and Customs working with external stakeholders to improve the guidance on travel and subsistence and the process for claiming tax relief on non-reimbursed employment expenses.

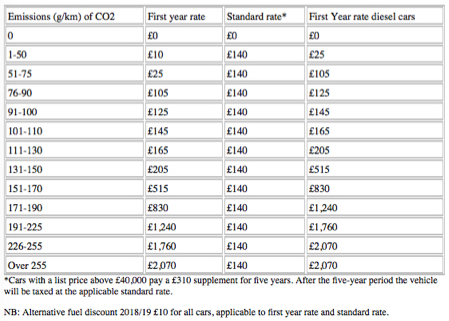

Vehicle Excise Duty

As part of the government’s focus on improving air quality - and in addition to the rise in the diesel company car tax supplement - a Vehicle Excise Duty (VED) supplement will apply to new diesel cars first registered from April 1, 2018, so that their First Year Rate will be calculated as if they were in the VED band above.

For example, a Ford Focus diesel (CO2 emissions 91-100g/km) will be subject to an additional £20 in the First Year, a Volkswagen Golf (CO2 emissions 111-130g/km) an additional £40, a Vauxhall Mokka (CO2 emissions 131-150g/km) £300 and a Land Rover Discovery (CO2 emissions 171-190g/km) £400, according to government figures.

It will not apply to next-generation clean diesels - those which are certified as meeting emissions limits in real driving conditions, known as Real Driving Emissions Step 2 (RDE2) standards.

The government forecasts that the policy change will have little impact on driver behaviour in terms of choosing a diesel car due to the “low level of the tax increase in relation to car purchase price”.

However, the government estimates the tax rise will raise an additional £125 million in 2018/19, reducing to £50 million in 2019/20 and £10 million in 2020/21.

From April 1, 2018, VED rates for cars, vans and motorcycles registered before April 2017 and the First-Year Rates for cars registered after April 2017 will increase in line with RPI.

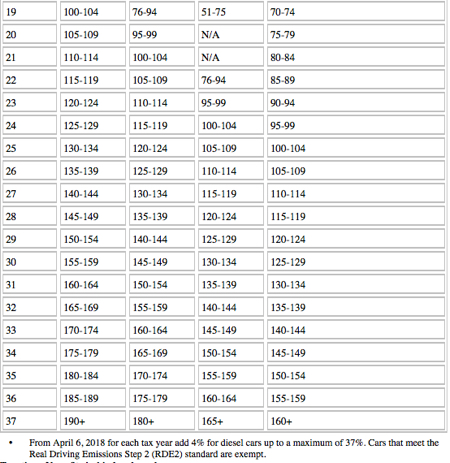

VED for cars first registered on or after April 1, 2018

*Cars with a list price above £40,000 pay a £310 supplement for five years. After the five-year period the vehicle will be taxed at the applicable standard rate.

NB: Alternative fuel discount 2018/19 £10 for all cars, applicable to first year rate and standard rate.

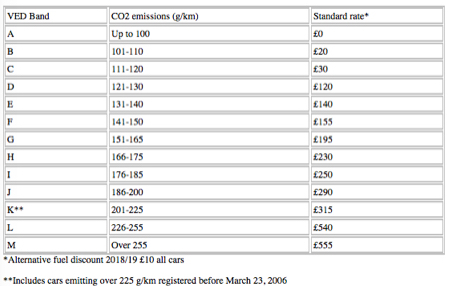

Vehicle Excise Duty from April 1, 2018 for cars registered on or after March 1, 2001 but before April 1, 2017

*Alternative fuel discount 2018/19 £10 all cars

**Includes cars emitting over 225 g/km registered before March 23, 2006

VED bands and 2018/19 rates for vans registered on or after March 1, 2001

Early Euro 4 and Euro 5 compliant vans - £140

All other vans - £250

Van benefit charge and van and car fuel benefit charge 2018/19

The government will increase the van benefit charge and the van and car fuel benefit charges by the September 2017 Retail Price Index. The change will have effect on and after April 6, 2018. The government will legislate by statutory instrument in December 2017 to ensure the changes are reflected in tax codes for 2018 to 2019.

The new figures have yet to be announced but sums for 2017/18 are:

• Car fuel benefit charge: £22,600

• Van benefit-in-kind charge: £3,230

• Van fuel benefit charge: £610

The charge for zero-emission vans remains at 20% of the main rate in 2017/18, but will then increase on a tapered basis to April 5, 2022 - 40% in 2018/19, 60% in 2019/20, 80% in 2020/21, 90% in 2021/22 and then equalising with the standard charge in 2022/23.

The government says it will review the impact of the incentive at Budget 2018 together with enhanced capital allowances for zero-emission vans.

Fuel duty

The scheduled rise in fuel duty from April 2018 has been cancelled. It is the eighth consecutive year that there has been no increase.

The government calculates that fuel duty freezes since 2011 will have saved the average driver a cumulative £850 and the average van driver more than £2,100 by April 2019, compared to what they would have paid under the pre-2010 fuel escalator plans.

Benefits-in-kind: electric vehicles

The government has clarified existing legislation so that from April 2018, there will be no benefit-in-kind charge on electricity that employers provide to charge employees’ electric vehicles.

It is understood that a number of employers have contacted HM Revenue and Customs asking if employer-provided electricity was a benefit-in-kind.

Ultra-low emission vehicles

To support the transition to zero emission vehicles, the government will:

• Regulate to support the wider roll-out of charging infrastructure

• Invest £200 million, to be matched by private investment into a new £400 million Charging Investment Infrastructure Fund

• Commit to electrify 25% of cars in central government department fleets by 2022

• Provide £100 million to guarantee continuation of the Plug-In Car Grant to 2020 to help with the cost of purchasing a new battery electric vehicle

• £40 million in charging research and development.

Connected and Autonomous Vehicles (CAVs)

The government wants to see fully self-driving cars, without a human operator, on UK roads by 2021.

The government will therefore make world-leading changes to the regulatory framework, such as setting out how driverless cars can be tested without a human safety operator.

The National Infrastructure Commission (NIC) will also launch a new innovation prize to determine how future roadbuilding should adapt to support self-driving cars.

Transforming Cities Fund

A £1.7 billion fund from the Northern Powerhouse Investment Fund will support intra-city transport.

It will target projects which drive productivity by improving connectivity, reducing congestion and utilising new mobility services and technology.

Half will be allocated via competition for transport projects in cities and the other half will be allocated on a per capita basis to the six combined authorities with elected metro mayors - £74 million Cambridgeshire and Peterborough, £243 million Greater Manchester, £134 million Liverpool City Region, £80 million West of England, £250 million West Midlands and £59 million Tees Valley

Pothole fund

The government has promised to invest an additional £45 million in 2017/18 to tackle around 900,000 potholes across England.

Tolls on Severn Bridges

As previously announced, the government will abolish tolls on the Severn Bridges at the end of 2018, and cut the tolls in January 2018 as the bridges come back into public ownership.

The Crossings will revert to government control on January 8, 2018, after which they will be managed by Highways England.

Following that date, the tolls will no longer include VAT, and so the rate of tolls will be reduced accordingly. That is in line with the government’s 2015 Budget announcement and will mean:

• Charges for cars and other vehicles up to nine seats will reduce from £6.70 to £5.60

• Charges for goods vehicles up to 3.5 tonnes and small buses will reduce from £13.40 to £11.20

• Charges for goods vehicles above 3.5 tonnes and large buses will reduce from £20 to £16.70.

Additionally, there will be no toll increase on January 1, 2018, as there has been in previous years.

Tolling will then continue until the end of 2018 at which point all charges at the Crossings will be abolished, as announced by the government in July 2017.

Keep up-to-date with all the latest news by following us on twitter.com/Scotcars

Jim McGill